Union Budget introduces a new tax regime

Send us your feedback to audioarticles@vaarta.com

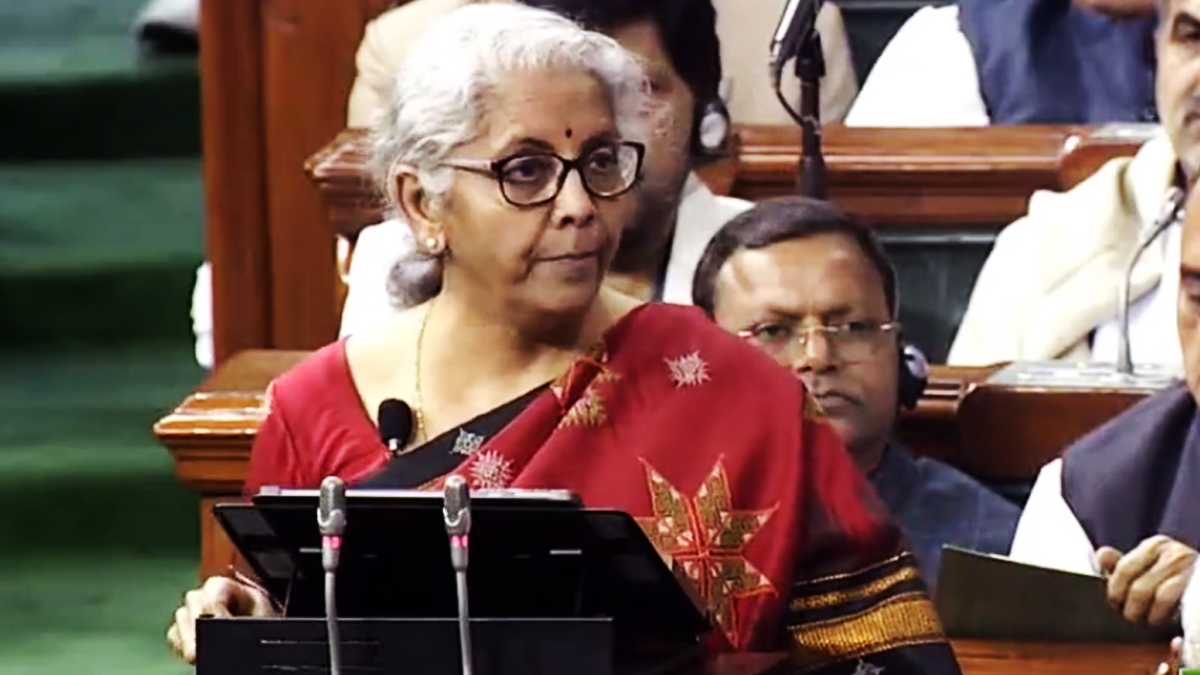

"Currently, those with an income of Rs 5 lakhs do not pay any income tax and I proposed to increase the rebate limit to Rs 7 lakhs in the new tax regime," Finance Minister Nirmala Sitharaman said on Wednesday, presenting the Union Budget 2023. The new regime has been introduced to give succor to the middle class.

Here is the breakdown:

Tax rates for Rs 0 to Rs 3 lakhs: Nil

Tax rates for Rs 3 to 6 lakhs: 5%

Tax rates for Rs 6 to 9 lakhs: 10%

Tax rates for Rs 9 to 12 lakhs: 15%

Tax rates for Rs 12 to 15 lakhs: 20%

Tax rates for income above Rs 15 lakhs: 30%

The above rates are not applicable if the tax payer opts for the old tax regime. Under the new tax regime, deductions are not allowed. This is mean to encourage citizens to spend rather than save.

The lack of deductions under the new regime is likely to receive flak from both tax payers and the Opposition. It will be years for this tax reform, which is meant to end fake proofs/submissions, to bear fruit in the overall system.

The FM today also said that surcharge rates have been reduced from 37% to 25% under the new regime.

What is the highest tax slab currently? Under the old regime, it continues to be 42.74%, while it is 39% under the new regime.

Follow us on Google News and stay updated with the latest!

Follow

Follow